Read Part one here.

If a Creditor forgives some of the debt you owe it, the IRS considers that amount as additional income for you that year. The Creditor can send you a 1099-C for the amount they wrote off and that is added to your total income. It may be enough to jump you into the next tax bracket – especially if it is a mortgage loan of tens of thousands of dollars.

During the few times clients ask me about debt consolidation, I advise them about the possibility of a 1099-C being sent to the IRS. I also tell them to seek the advice of an accountant or a tax attorney as to any forgiven debt and its tax consequences. This, plus the fact that SOME debt consolidation companies are scams, are enough to convince them not to abandon the idea. There ARE plenty of good debt consolidation companies out there, and I recommend a few – particularly Clearpoint – but otherwise caveat emptor (Google it)!

In over 5000 bankruptcies filed, I have had perhaps one percent of my Debtors receive a 1099-C on the forgiven debt. But since they filed for bankruptcy and received a discharge, there IS something they can do about it.

If you filed bankruptcy and received a discharge, and you later receive a 1099-C on the debt from the Creditors, you do not have to worry about it. You still have to DO something about it, but you do not need to WORRY about it.

Simply, a debt discharged in bankruptcy is notforgiven, instead the creditor is required to stop collecting the debt! The debt is still owed, but it is uncollectible, so the creditor might as well write it off on their own taxes and submit it to their insurance.

But they send out a 1099-C to you anyway. Why? Good question, do they get any monetary benefit from it? No, unless it helps keep their bankruptcy insurance premiums down, I suppose. They report it to the IRS and now you have to spend extra time and forms.

How can they send the IRS a 1099-C form on a debt that has not, technically, been forgiven? Another good question. I am not a tax attorney and the tax code is second only to the Harry Potter series in page count. Perhaps somewhere in that former rainforest of volumes, the tax code says that debt discharged in bankruptcy still counts as forgiven debt (although it is excepted). Perhaps it says the opposite; perhaps it does not address it at all (most likely).

Perhaps it may mention what happens when a company sends the IRS an intentionally false 1099-C. An Attorney General (state or federal) looking to make some bonafides with a non-big-business constituency can look into this if they are looking for some political clout should they ever run for office.

I am sure some attorney, SOMEWHERE, has looked into this…

Regardless, the credit company sent you a 1099-C on a debt you discharged in bankruptcy. You HAVE to claim it on your taxes – the IRS has a copy of the 1099-C as well and will be looking for that income on your returns! What do you do?

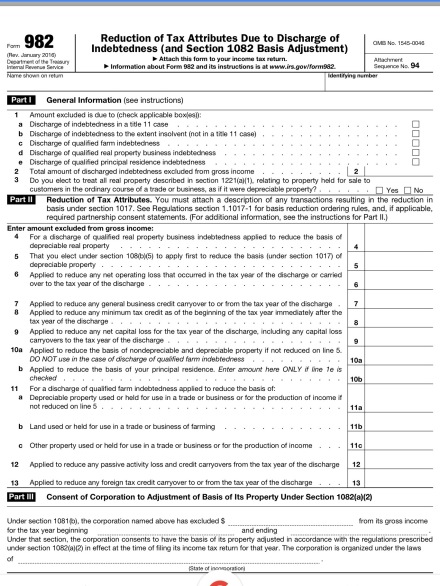

When you file your taxes, you should also file a Form 982, labelled Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment).

Fill in your name and social security number, check box 1a and fill in Line 2 with the amount on the 1099-C. Then complete the rest of Form 982 and file it with your taxes.

Don’t do this by yourself! I cannot stress this enough! It’s okay to get the forms free online, but take them to an accountant or a good tax preparer. I have nothing against the people who work in the kiosks in discount department stores or the people who volunteer their time at churches and care facilities who help with taxes. If not for the 1099-C I have no problem recommending you go to them to help you with your taxes. But this is worth paying a little extra. Remember – the IRS is waiting for you to account for the amount on that 1099-C.

Same for credit companies. Some loan companies will help you file your taxes. That’s fine … but they may be the same companies that will send you their own 1099-C in the future.

If you discharged the debt in bankruptcy, a 1099-C is nothing to worry about, although it may cost you extra time and costs when you file your taxes (you can deduct the cost of the tax preparer on next year’s taxes if that is any consolation). A 1099-C is the final thrash at you from a discharged creditor.

Mean? Yes. Petty? Yes. Are you stuck with it? Yes. Can you do something about it? Yes – if it was discharged in bankruptcy.

Original Material Copyright 2016 Michael Curry

No comments:

Post a Comment