Bankruptcy clients rarely receive a 1099-C. Only on certain specific debts do I advise a client that after discharging their debt they might get a 1099-C in the mail. Usually mortgages, specifically mortgages with Greentree.

Also, they come in waves every few years. Earlier this year (2016) I had four or five calls from clients about getting a 1099-C. This is the first time I have had to handle calls about it in about five years. I suspect that the person in charge of doling them out at a credit company has moved on and a new person takes over the department trying to make his (or her) bones by inflicting these flimsy pieces of paper on their heretofore loyal customers.

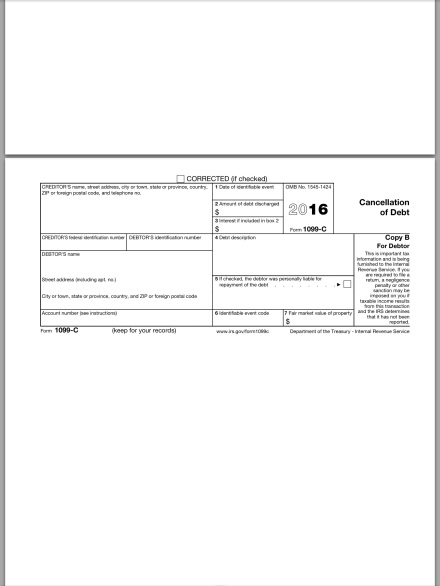

What is a 1099-C form? When a creditor forgives a debt that you owe, it can send a 1099-C to the IRS and that counts as part of your income you must report and on which you must pay taxes.

What?!

Let’s suppose you owe a credit card $11,000.00. Miraculously you have managed to persuade the company to accept $6,000.00 in one lump payment and they write off the rest. They agree and do not renege. You pay (somehow managing to collect the money – hopefully not as a loan from another credit card company thereby going from the frying pan into another frying pan) and they still do not renege.

(Keep in mind this is a fantasy only used as an example. The odds of a credit card company actually agreeing to something like this and not weaseling out of it even after payment are the same as winning the lottery – so you might as well win the lottery and pay off the card entirely…).

Everyone is now happy. Until you get a letter from the credit card company some months later containing a 1099-C. Now you have to declare that $5,000.00 that was forgiven as income.

Note that you have to declare that $5,000.00 as income whether you get a 1099-C or not!

The logic, that word used loosely, is as follows: now you do not have to pay that $5,000.00. You have five grand you would not have had if the credit card company had not forgiven the debt. That $5,000.00 is income for the year in which it was forgiven.

“But it would have taken me more than five years to pay off that $5,000.00, why does it count for only that one year?” Don’t try to argue around this with reason and sensibleness …

Imagine this family earns $35,000.00 per year. For 2016, their income will be $40,000.00. If this person is single they are in a new tax bracket – 25% instead of 15%.

The problems come in with real estate mortgages – either modifications or short sales or whatever the latest scheme is from the mortgage companies. In cases like this we are not talking about a “few” thousand, but tens of thousands. Suppose the bank writes off $60,000.00 from the house you just gave back to them. They send you a 1099-C.

Now you go from $35,000.00 to $95,000.00. That a jump up one tax bracket for a married couple, two brackets for a single person!

Here’s an ugly scenario: imagine if the student loan problem is resolved and the government starts forgiving loans. What if THEY start sending out 1099-Cs? You might go from owing the Department of Education $200,000.00 to owing the IRS $100,000.00! And the IRS doesn’t believe in forbearance or deferment! {Note that if a student loan was forgiven because the person who received the loan worked in an underprivileged area as a teacher or a physician (remember that was the original premise for the TV show “Northern Exposure”), that is an exception to this rule.}

Does the credit card or mortgage company benefit from this? No. They do it because 1) they are required to under the tax code, and (more likely) 2) it tickles them.

What can you do? Not much, I’m afraid. You will have to consult an accountant or a tax attorney. You can except the “income” from a 1099-C only in certain circumstances – proving insolvency, if the debt was your home, your business or farm property … things that go beyond this blog and my expertise.

Speak to an accountant or a tax attorney for ways to stave off the extra income. Tax avoidance versus tax evasion.

Can you file bankruptcy on the debt? No, as there is no debt to discharge. I have had to break this bad news to a few clients in my twenty years of practicing bankruptcy, but not many. And remember – even if the creditor did NOT send you (and the IRS) a 1099-C, it is still your duty to report it as income!

But what if it WAS for a debt that was discharged in bankruptcy?

Ah, that is another story altogether! And a story with a happy ending!

Original Material Copyright 2016 Michael Curry

No comments:

Post a Comment